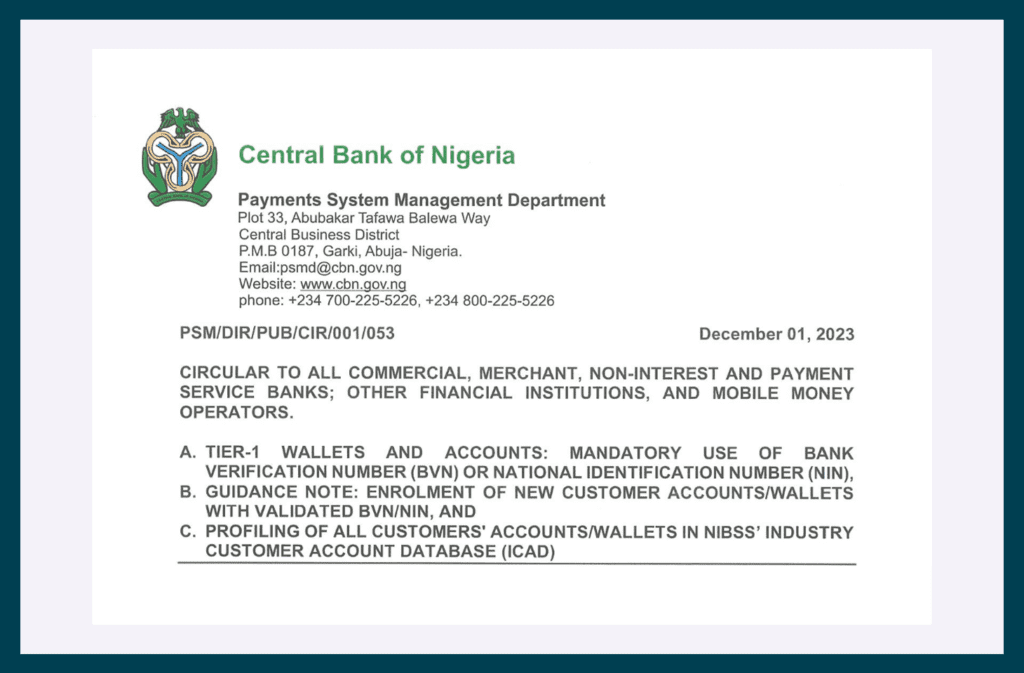

The regulatory landscape across the continent is dynamic and subject to constant changes. In a recent development, the Central Bank of Nigeria (CBN) issued a memo introducing a series of updates to strengthen the stability of the country’s financial system. These changes are expected to impact certain aspects of Know Your Customer (KYC) procedures. As a prominent player in compliance and security infrastructure within and beyond Africa, we have delved into the implications of these updates for your business. In this guide, we aim to simplify and elucidate what these changes mean for you and provide insights on ensuring compliance with the latest modifications. This is your accessible handbook for navigating the recent alterations in the Regulatory Framework for Bank Verification Number (BVN) Operations and Watchlist for the Nigerian Banking Industry.

The CBN’s Financial Stability Mission: A Wave of Transformation

So, what is the update? The CBN is on a mission to enhance the stability of the financial system, and strengthening KYC procedures in financial institutions is a vital part of this journey. This mission comes to life through an update to Section 1.5.3 of the Regulatory Framework for BVN Operations and Watch-List, a change with significant implications for businesses like yours.

Key Changes: What You Need to Know

- Mandatory BVN/NIN for Tier-1 Accounts:

Get ready for a game-changer—every Tier-1 bank account and wallet now needs a BVN and/or NIN.

- BVN/NIN for Tier-2 & 3 Accounts:

Tiers 2 & 3 are also part of this change. Individual accounts in these tiers must now display their BVN and NIN.

- A New Era for Account Opening:

The process for account opening shall commence by electronically retrieving BVN or NIN-related information from the NIBSS’ BVN or NIMC’s NIN databases and for the same to become the primary information for onboarding new customers.

- All existing customer accounts/wallets for individuals with validated BVN shall be profiled on the NIBSS’ ICAD immediately and within 24 hours of opening accounts/wallets.

What does this mean for you?

Effective immediately, no new Tier 1 accounts and wallets should be opened without BVN or NIN. By March 1, 2024, all funded accounts or wallets without BVN or NIN will be placed on “Post No Debit or Credit,” no further transactions will be permitted until the new process is completed.

Read more from the memo here.

Our BVN/NIN Endpoint: Designed for Your Compliance Success

To help your business easily navigate this new compliance update, our NIN and BVN endpoints are readily available for your advantage. Here’s why it’s a game-changer for your business:

- Exclusive Benefits: A Seamless and Secure Experience

Our BVN and NIN endpoints are designed with your business needs in mind. With over 5 unique data points, we offer you a seamless experience to verify your customers’ BVN or NIN effortlessly. The process is secure, ensuring that your customers’ sensitive information is handled with the utmost care and confidentiality. This enhances your business’s credibility and builds trust with your customers, knowing their information is safe.

- Advanced Technology: Secure and Accurate Identity Verification

Our BVN and NIN endpoints guarantee secure and accurate identity verification. You only need to input your customer’s BVN or NIN; our system will swiftly handle the process. Our technology verifies the BVN or NIN and presents you with an accurate real-time response. This means you can trust the verification results, ensuring your business operations are based on accurate and reliable information.

- User-Friendly: A Straightforward Verification Process

We understand that time is a valuable resource in your business. That’s why we’ve made the verification process user-friendly and straightforward. With just a few clicks, you can verify your customers’ identity. This simplicity does not compromise the process’s effectiveness, ensuring you get accurate results quickly and efficiently.

Overall, our BVN and NIN endpoints are more than just verification tools; they are your partners in ensuring a secure, seamless, and user-friendly experience for your business. With our various compliance certifications, we’ve designed all our endpoints to help you confidently navigate the dynamic business landscape, knowing that you are backed by advanced technology and a user-friendly interface.

Learn more about our endpoints here.

What You Need to Do.

We strongly recommend that you familiarize yourselves with the new update from the CBN to efficiently navigate the compliance landscape for all institutions regulated by the CBN, as any breaches identified will face appropriate sanctions, ensuring your business operates within a robust and compliant financial ecosystem.

In conclusion, you can always stay informed and secure, and navigate new and existing compliance updates by visiting and subscribing to our compliance tracker platform. We’re here to ensure your business navigates through these changes smoothly while you focus on your day-to-day business.

Leave a Reply

You must be logged in to post a comment.