In carrying out business online, ensuring the authenticity of documents is crucial for preventing fraud and maintaining trust. Identity document verification plays a vital role in confirming the legitimacy of various documents, helping organizations safeguard against tampering and counterfeiting. This process is particularly important in customer onboarding, where quick and secure verification of identity documents is essential.

What is Document Verification?

Document verification is the process of confirming the authenticity of documents such as passports, driver’s licenses, and ID cards. The process examines both physical and digital features to ensure that the documents are genuine and have not been altered. For instance, the physical verification process might check the texture, color, and security features like watermarks, while digital verification uses AI-powered tools to analyze the document’s data.

The Identity Document Verification Process

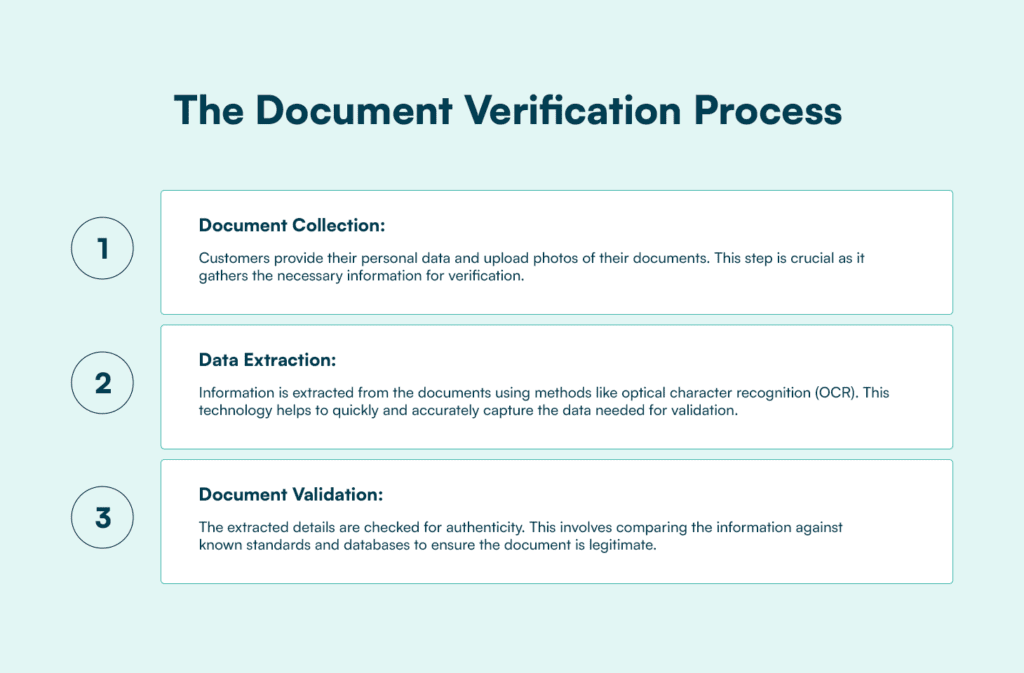

The document verification process typically involves four main steps:

- Document Collection: Customers provide their personal data and upload photos of their documents. This step is crucial as it gathers the necessary information for verification.

- Data Extraction: Information is extracted from the documents using methods like optical character recognition (OCR). This technology helps to quickly and accurately capture the data needed for validation.

- Document Validation: The extracted details are checked for authenticity. This involves comparing the information against known standards and databases to ensure the document is legitimate.

Importance of Identity Document Verification

Document verification is essential for several reasons:

- Fraud Prevention: By identifying forgeries and ensuring that the information provided is accurate, document verification helps to prevent fraud. This is particularly important in industries dealing with sensitive information or high-value transactions.

- Customer Trust: Verifying the identity of individuals helps build trust with customers. Knowing that their documents are being securely and accurately verified assures them that their information is safe.

- Industry Applications: Document verification is used across various industries, including financial institutions, healthcare, and e-commerce, to ensure the authenticity of documents protect against fraud, and conduct due KYC & KYB Checks.

Physical vs. Digital Document Verification

Physical Verification involves checking the physical attributes of a document, such as texture, and color, and security features like holograms and watermarks. It often requires a skilled specialist to manually inspect the document.

Digital Verification utilizes AI-powered tools, digital verification allows for remote verification by extracting and comparing document data with user information. This method is more efficient and can be done quickly and accurately from anywhere.

Why Businesses Use Document Verification?

Businesses use document verification for several reasons:

- Enhanced Risk Management: Document verification offers a convenient and user-friendly way to manage risk by ensuring the authenticity of documents.

- Increased Efficiency: Automated verification processes are faster and more efficient than manual checks, reducing the time needed to verify documents.

- Global Access: Digital verification enables businesses to verify documents from anywhere in the world, facilitating global operations.

- Regulatory Compliance: Ensuring adherence to regulations such as Know Your Customer (KYC), Know Your Business (KYB), Anti-Money Laundering (AML), and Customer Due Diligence (CDD) is critical for many industries. Document verification helps businesses stay compliant with these regulations.

Challenges of Manual Document Verification:

Manual document verification can be challenging due to several factors:

- Lengthy and Labor-Intensive: The process requires skilled specialists and extensive training, making it time-consuming and labor-intensive

- Risk of Human Error: Manual processes are prone to mistakes, which can lead to incorrect decisions and increased risk for the organization

- Slow Processes: The time required for manual verification can cause delays and lead to customer frustration.

How Prembly’s Document Verification Works

We offer advanced ID and verification solutions, including facial recognition, liveness detection, and biometrics. Our online document verification is seamless and instantly returns the due responses.

Registered Prembly Account Holders (businesses) log in to start and new account holders will need to sign up, upload the required business documents and licenses, and either verify with access to the dashboard to start conducting checks or deny if the uploaded requirements do not support the legitimacy of the business in question.

As a verified account holder with a Prembly dashboard, you can navigate on your dashboard and click the “Document Verification” feature, where you upload the required document after selecting the region of the originating document.

Account holders take a photo of the ID card, passport, or document in question for analysis with real-time feedback, whereas Prembly provides real-time feedback to help account holders capture a good-quality photo.

Choosing Document Verification Software

When selecting a document verification provider, consider the following factors:

- Global Document Coverage: Ensure the provider can verify documents from various countries. Verify documents globally with Prembly.

- Ease of Implementation: Look for solutions that are easily integrated into your existing systems. At Prembly, our integration is one of the most detailed and straightforward processes.

- Language Support: Check if the provider supports multiple languages. Prembly supports multiple language options

Learn more: docs.prembly.com

Sign up: account.prembly.com.