Since 2019, Hereconomy has worked tirelessly to bridge the economic gender gap across Africa. This pioneering fintech company, is the first of its kind in Nigeria. It has exclusively empowered women across the continent with financial services, capacity building, community, and opportunities. However, the unique needs of this distinct audience demanded a blend of convenience, flexibility, and security.

Where the online space is riddled with complexities, providing frictionless financial services while ensuring security is a Herculean task. It would typically require strenuous manual checks and significant hard work. However, Hereconomy, always a step ahead, recognized the need for an automated, seamless identity verification solution. The team was determined to avoid the pitfalls of onboarding fake identities. Thus, the quest for a solution to distinguish between genuine and fraudulent users while ensuring a smooth sign-up and onboarding process became paramount.

About Hereconomy

Herconomy is Nigeria’s first Fintech company for women dedicated to empowering female entrepreneurs and professionals through Financial Services, Capacity Building, Community, and Opportunities.

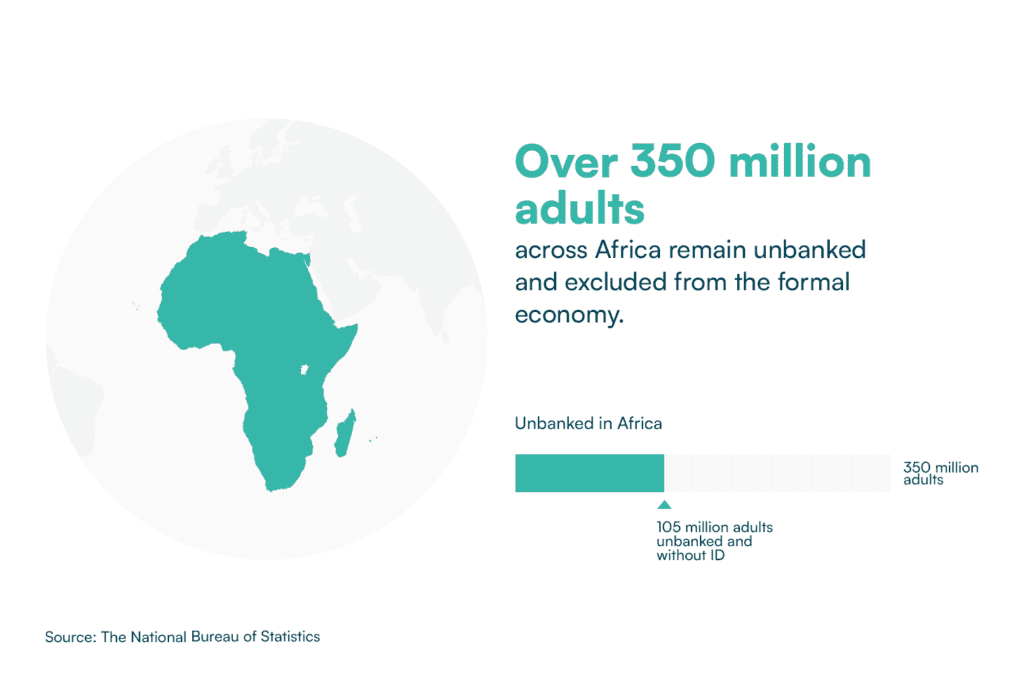

The National Bureau of Statistics reports that financial inclusion is vital for reducing poverty and boosting prosperity, enabling seven Sustainable Development Goals (SDGs). Yet, over 350 million adults across Africa remain unbanked and excluded from the formal economy. In Sub-Saharan Africa alone, 105 million adults are unbanked and without ID. These individuals, especially vulnerable women in rural areas, rely heavily on cash or informal providers, a system that is both costly and risky.

Hereconomy, with its belief that saving is the first step towards financial buoyancy and wealth management for women, has been promoting the transformative power of a saving culture. Through the slogan “save, earn, learn, connect, and thrive,” the company has successfully driven this narrative, as evidenced by the success of several saving challenges run by the community.

For more information about Hereconomy, visit https://herconomy.com/

The Need for an Identity Verification Solution

As a Microfinance Bank (MFB), Hereconomy has a distinct plan to onboard unbanked women by opening tier 1 accounts and helping them access all the perks of the Hereconomy app via a robust agent network. Offering credit to customers is also one of the company’s key ambitions. These service offerings, coupled with the fact that they are specific for women, underscored the need for an automated digital identity solution. This would allow women to sign up and enjoy the company’s services efficiently.

Hereconomy sought a strong identity verification platform to combat global identity theft on their platform. This led to the integration of Identitypass by Prembly, a solution that perfectly balances convenience, safety, and adaptability.

The Results: Seamless and Effective Fraud Reduction Solutions

The results of this integration were immediate and impressive. With the integration of Identitypass into its verification process, Hereconomy has access to over 30 unique endpoints. This are in its Nigerian marketplace. In cases where global verification is needed, they utilize the document verification endpoint. This endpoint allows them to verify over 3500 distinct documents across multiple regions. This has significantly reduced fraud cases and successful fake identity sign-ups.

Identitypass integration reduced team workload, shifting focus from medium-risk users to instantly flagging suspicious sign-ups.

Hereconomy uses Identitypass to address challenges from non-compliance in African fintech. This is just the start for Hereconomy’s growth and innovation in payments with Identitypass.

The benefits of integrating the proper identity verification partner is overcoming fraud challenges. This is a way to embrace innovation, and prioritize customer trust which cannot be over-emphasized for businesses across the globe. Identitypass, has over 80 unique identity verification endpoints across different countries. This has proven the most effective for companies looking to confidently expand their services across emerging markets.

Get started with Identitypass, sign up at https://prembly.com/identityPass.

Leave a Reply

You must be logged in to post a comment.