Over the past year as the Product Manager for IdentityRadar, I’ve realized that building products involves many comprehensive processes. Among various daily tasks, my primary responsibility is ensuring we deliver a comprehensive and intelligent solution to one of the biggest challenges businesses face today—online fraud and risk management. The real challenge isn’t just identifying risks, but doing so efficiently and proactively, empowering companies to act before these risks escalate into real problems.

In our business environment today, companies are constantly exposed to various risks. These could stem from financial fraud, regulatory violations, sanctions, or involvement with politically exposed persons (PEPs). With the amount of data being processed daily, it’s easy for companies to miss critical red flags or fail to identify high-risk transactions. This oversight could lead to financial losses, reputation damage, and hefty regulatory penalties. But the problem isn’t just about data volume; it’s also about complexity. Different risks come from different sources, and they all require careful monitoring and a keen eye for detail.

Most businesses are often caught off-guard by risks hidden in their data, simply because their tools are not capable of spotting subtle patterns or connections that could indicate a problem. In this sense, companies aren’t just playing defense, they’re constantly chasing after the risks they didn’t see coming.

At Radar, the product we’ve built helps businesses get ahead of risk by offering onboarding screening, real-time monitoring, smart analytics, and advanced pattern detection. Here’s how we achieve these:

- Onboarding Screening: Radar helps businesses evaluate and assess new customers or clients during the initial stages of their relationship with a business. This screening helps identify potential risks such as links to politically exposed persons (PEPs), sanctions lists, or adverse media.

- Real-Time Monitoring: One of the most significant advantages of Radar is its ability to monitor transactions and customer activities in real-time. Gone are the days when companies had to rely on post-transaction reviews to catch potential fraud or sanctions violations. Radar provides businesses with an immediate view of what’s happening, allowing them to act swiftly and decisively.

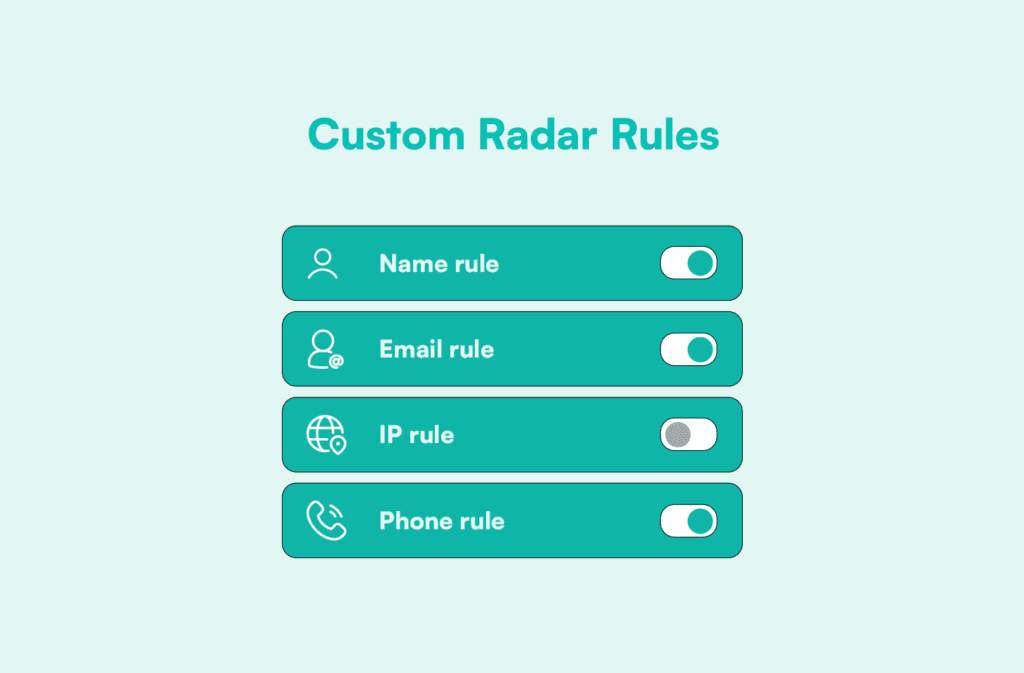

- Intelligent Risk Scoring: Radar uses sophisticated algorithms to score transactions and individuals based on risk factors like involvement in high-risk industries, connections to sanctioned entities, or presence on watchlists. This scoring system is customizable, allowing companies to adjust the sensitivity based on their risk appetite and regulatory requirements. As a result, businesses can focus on the riskiest activities without being overwhelmed by false positives.

- Data-Driven Insights: With Radar, it’s not just about detecting risks in isolation. We integrate multiple data sources—internal and external—and use them to build a complete picture of a customer or transaction. Whether it’s cross-referencing a user’s activities with external PEP lists or tracking the flow of funds across high-risk jurisdictions, Radar ensures that all the dots are connected, making hidden risks visible.

- Simplified Decision-Making: For many companies, even after identifying risks, the decision-making process is complicated by the sheer amount of data to analyze. Radar simplifies this by offering clear, actionable insights. We’ve built a platform that not only highlights potential problems but also provides context and suggestions on the next steps. Whether it’s flagging a transaction for review or blocking a transaction, Radar empowers businesses to act decisively and quickly.

- Continuous Adaptation: Risk isn’t static. As industries evolve, so do the threats. Radar’s flexibility allows businesses to continuously adapt their risk management strategies. Our product integrates with emerging technologies and regulatory changes, ensuring that businesses remain compliant and well-guarded against new forms of risk. This adaptability means Radar is always one step ahead, keeping businesses safe in an ever-changing environment.

My journey as a Product Manager for Radar has been about solving a persistent, evolving problem which is to help businesses protect themselves from the complexities of modern-day risks. We understand that no two businesses are the same, and neither are their risk profiles. That’s why we’re committed to building a product that’s not only robust and intelligent but also tailored to the specific needs of each user. By equipping businesses with the tools to detect and mitigate risks proactively, Radar turns risk management from a reactive process into a strategic advantage.

At the end of the day, my role is about ensuring that Radar isn’t just another tool in the compliance toolbox but to make it the sharpest and most reliable one. We’re giving businesses the confidence to face the unknown, knowing that no matter what risks lie ahead.

Learn more about Identityradar here.