In recent times, cyber threats have been on the rise, crumbling many business processes and leading to the closure of businesses due to fraud. Businesses are out there looking for the best means to ensure that they stay in total control of their business processes, one of those ways is by implementing KYC, which typically just ensures that individuals are who they claim to be during onboarding and even after they get onboard. In this blog post, we will unpack various identity verification techniques and their significance to both business owners and their customers in our increasingly online-driven world.

This guide aims to give you a solid understanding of what identity verification entails and why it’s a key component in protecting both personal and corporate data. Whether you’re a business owner, IT professional, or just curious about the subject, this post will equip you with valuable insights.

What is Identity Verification?

Identity verification is the process of ensuring that a person is who they claim to be. With the rise of online services and transactions, confirming someone’s identity has become a core part of security practices across various industries. This process helps to protect against fraud and unauthorized access, making sure that the right people gain access to sensitive information or services.

Why Identity Verification Matters

Let’s think about it: in the digital world, how can you trust someone you can’t see or meet in person? This is where identity verification steps in, adding a layer of trust. By validating identities, businesses can:

- Prevent Fraud: Unauthorized transactions and identity theft are major concerns for businesses, and with the increased use of AI, it is now easier for bad actors to manipulate the system and

- Ensure Compliance: Many industries have regulations requiring identity checks.

- Build Trust: Clients feel safer knowing their identities are protected.

Basic Principles of Identity Verification

The foundations of identity verification revolve around a few key principles:

- Something You Know: This includes personal information like passwords or answers to security questions.

- Something You Have: Physical items such as ID cards, smartphones, or tokens.

- Something You Are: Biometrics like fingerprints, facial recognition, or retinal scans.

By combining these elements, systems can ensure a higher level of security. Think of it like a three-key vault—each key alone isn’t enough, but together, they unlock access.

Techniques Used in Identity Verification

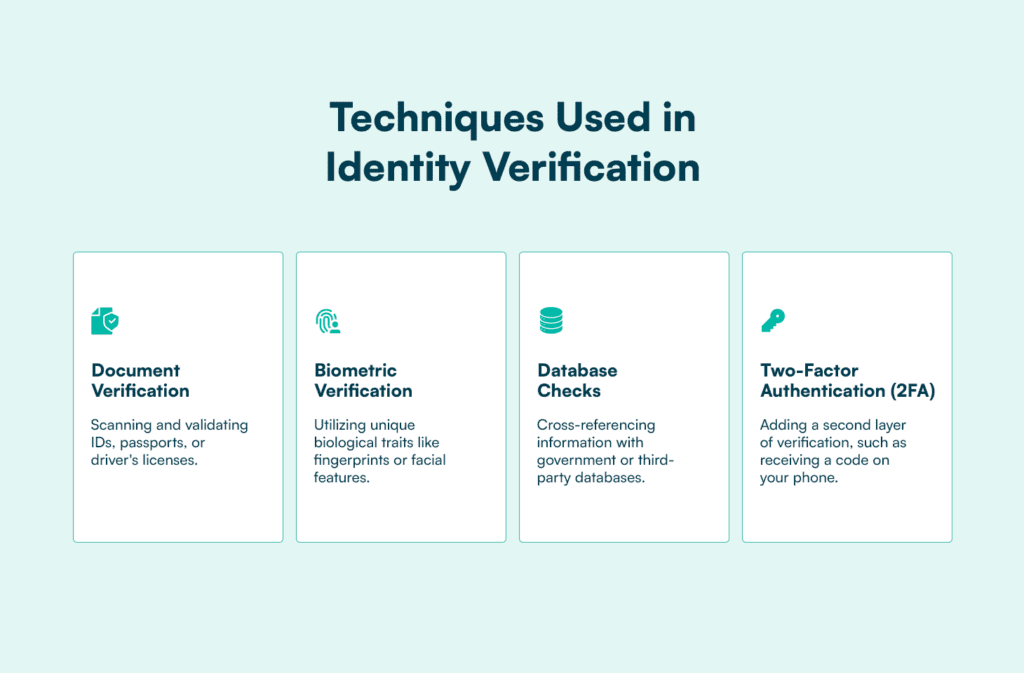

Modern identity verification employs multiple techniques, often using technology to increase accuracy and efficiency. Here are some common methods:

- Document Verification: Scanning and validating IDs, passports, or driver’s licenses.

- Biometric Verification: Utilizing unique biological traits like fingerprints or facial features.

- Database Checks: Cross-referencing information with government or third-party databases.

- Two-Factor Authentication (2FA): Adding a second layer of verification, such as receiving a code on your phone.

Each method has its strengths, and often, businesses use a combination to enhance security.

Why Identity Verification is Important

The place of identity verification in our current reality cannot be overemphasized, it is a cornerstone of security and trust. It’s like the security at a bank, making sure only the right people get in. When handled right, it can prevent fraud, ensure regulatory compliance, and build user trust. Here are some reasons why identity verification must be prioritized in every organization

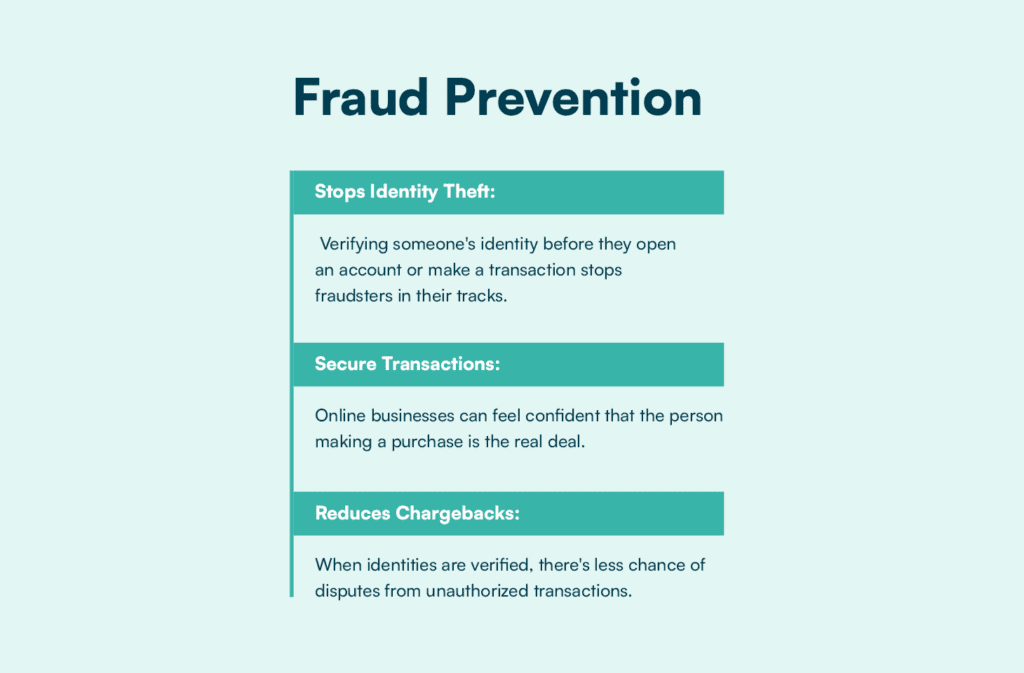

Fraud Prevention

Identity verification is the first line of defense against fraud. Imagine someone trying to break into your house. Robust ID checks are like strong locks on every door and window. Here’s how it works:

- Stops Identity Theft: Verifying someone’s identity before they open an account or make a transaction stops fraudsters in their tracks.

- Secure Transactions: Online businesses can feel confident that the person making a purchase is the real deal.

- Reduces Chargebacks: When identities are verified, there’s less chance of disputes from unauthorized transactions.

By implementing strong identity verification, businesses can protect themselves and their customers from fraudulent activities.

Regulatory Compliance

Identity verification isn’t just about security; it’s also crucial for meeting legal requirements. Regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering) make it mandatory.

- KYC Requirements: Banks and financial institutions need to know their customers to prevent illegal activities.

- AML Regulations: These laws are designed to stop money laundering and terrorist financing. Identity authentication is a key part of this effort.

- Avoiding Penalties: Companies that fail to comply with these regulations can face hefty fines. Proper identity verification helps them stay out of legal trouble.

Following these rules not only keeps businesses legal but also contributes to a safer, more transparent market.

User Trust and Experience

Think about how you feel when you know a website is secure. You relax, you trust it. Robust identity verification can give customers that same peace of mind.

- Builds Trust: When users know their identities are protected, they’re more likely to do business.

- Improves User Experience: Streamlined verification processes can make interactions smoother and more enjoyable.

- Increases Loyalty: Trustworthy platforms can turn one-time visitors into loyal customers.

People want to feel safe online, and solid identity validation shows that a business takes its security seriously. This trust can translate into higher satisfaction and repeat business.

Identity verification is a powerful tool that can safeguard against fraud, ensure compliance, and enhance user experience. By taking it seriously, businesses can create a safer and more trustworthy digital environment for everyone.

Conclusion

As we move deeper into a digital-first world, identity verification plays a crucial role in maintaining security and trust. By understanding its principles and applications, businesses and individuals can better protect themselves from potential threats.

At Prembly, we’ve built and are continuously building digital products that enable businesses across the globe to verify their customers’ identities using relevant government data, documents, and even their unique physical attributes via our biometrics products.

Learn more about our endpoints and get started here.