Technology is constantly evolving, and as our lives become increasingly intertwined with digital systems, the importance of adapting to these changes cannot be overstated. In the digital age, many transactions rely on the reliability and security of Know Your Customer (KYC) and identity verification processes. Keeping pace with the disruptions brought about by technological advancements is crucial.

The tech world has seen significant changes in recent years, particularly in the identity verification space. We’ve witnessed a dramatic shift from traditional paper methods to companies digitizing their verification processes to ensure the authenticity of their customers. However, some companies struggle to keep up with the rapid pace of change. Tech disruptors predict more disruptions in the coming years. As a leader in the digital identity verification space, it’s important to highlight these emerging technologies and their roles in the evolving world of identity verification. In 2024, several emerging technologies are revolutionizing KYC and identity verification, ensuring greater security, efficiency, and user control.

This article provides a brief overview of the upcoming evolution of KYC methods for businesses to authenticate and validate identities online.

Blockchain Technology:

Blockchain is a decentralized database serving as a public ledger to record transactions autonomously, eliminating the need for third-party validation. Distributed across a peer-to-peer network, it comprises interconnected data blocks forming an unalterable chain of records. Each node in the network retains a ledger copy to prevent single-point failure. Transactions are added sequentially, creating permanent and tamper-proof records.

Recognized for its decentralized and tamper-resistant attributes, blockchain significantly enhances KYC processes. By housing identity data in a distributed ledger, blockchain ensures data integrity, immutability, and transparency, mitigating identity fraud risks and establishing a secure foundation for identity verification. With blockchain, individuals gain confidence in safeguarding personal information from unauthorized access or alterations.

Machine Learning (ML) and Artificial Intelligence (AI):

ML and AI algorithms have become indispensable assets in KYC and identity verification. AI and ML-powered compliance solutions are pivotal in assisting banking compliance leaders to combat financial crime, bolster operational resilience, prevent regulatory fines, fortify the bank’s reputation, and enhance profit margins. These technologies facilitate advanced pattern recognition, anomaly detection, and predictive analysis, significantly improving the accuracy and efficiency of identity verification. By continuously learning from data patterns, ML and AI systems adapt to evolving threats, identifying suspicious activities in real-time and aiding organizations in outmaneuvering fraudsters.

Digital Identity Wallets:

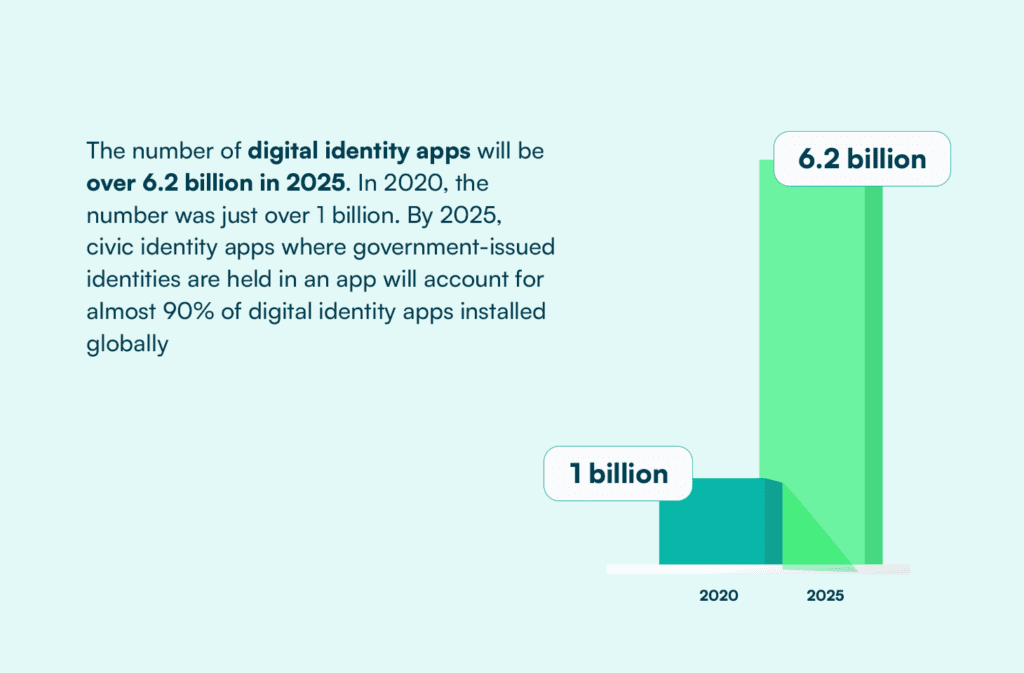

The number of digital identity apps will be over 6.2 billion in 2025. In 2020, the number was just over 1 billion. By 2025, civic identity apps where government-issued identities are held in an app will account for almost 90% of digital identity apps installed globally. In 2024, digital identity wallets gain momentum as user-centric identity management solutions. Empowering individuals to securely control personal data and selectively share it with trusted entities, these wallets leverage cryptographic techniques, enabling authentication without divulging unnecessary personal information. This enhances privacy and streamlines the KYC process by eliminating redundant identity checks across various platforms.

Self-Sovereign Identity (SSI):

SSI involves managing digital identities in a decentralized manner, allowing users to self-manage identities without relying on third-party providers. This paradigm shift in identity management and verification empowers individuals to own, control, and share identity information autonomously, ensuring greater privacy, security, and user autonomy. SSI solutions in 2024 facilitate seamless management of digital identities across multiple services and platforms, enabling individuals to establish trust and verify identities while preserving privacy and avoiding exposure of sensitive information to third parties.

Geolocation and Geo-fencing:

Geolocation and geofencing technologies play vital roles in identity verification by leveraging location-based data. These technologies verify the physical presence of individuals during identity verification, enhancing security. Geolocation data helps detect suspicious activities such as account takeover attempts or identity theft in real-time. Geo-fencing allows organizations to define virtual boundaries and restrict access based on geographic location, further bolstering security and regulatory compliance.

As we navigate the digital age, the importance of secure and efficient identity verification cannot be overstated. The landscape of KYC and identity verification is undergoing a rapid transformation fueled by the advent of innovative technologies. From the decentralized security of blockchain to the user-centric approach of digital identity wallets and self-sovereign identity, these technologies are reshaping how we verify identities and redefining our approach to privacy, security, and user autonomy.

Looking ahead, it’s clear that the future of identity verification is not just about keeping pace with technological advancements but also about embracing these changes to create a more secure, efficient, and inclusive digital world. For us at Prembly, the journey is ongoing, and as we explore and adopt these emerging technologies, we are not just responding to the evolution but actively shaping it.

Learn more about Identitypass by Prembly, an advanced digital identity verification service provider.