Let me take you through residence verification as a critical part of background checks and Know Your Customer (KYC) processes. This process involves confirming an individual’s address to ensure accurate identification. This step is important in several areas such as:

- Fraud Prevention: Reliable address information helps reduce risks associated with identity theft and financial fraud.

- Compliance: Accurate residence data is essential for meeting regulatory requirements, especially in financial services that may include banks.

- Risk Analysis: Understanding an individual’s residential history helps organizations assess potential risks.

I will help you explore the importance of residence verification, its role in compliance and fraud prevention strategies, and best practices for implementing effective KYC processes. By the end of this article, its my hope that you will have gained some insights and understanding into residence verification and how it supports your organizational integrity and security.

The Importance of Residence Verification in Background Checks and KYC

Residence verification is critical in establishing a reliable framework for fraud prevention and identity verification. Accurate address verification helps to:

- Prevent fake identities: Accurate address confirmation helps to weed out false or fabricated identities, reducing the chances of fraud during onboarding.

- Analyze residential history: Understanding a customer’s residential history can reveal potential risks associated with their identity. This analysis aids in identifying patterns that may indicate fraudulent behavior.

- Ensure compliance: Adhering to regulatory requirements is essential in financial services and other industries. Residence verification supports compliance with anti-money laundering (AML) laws and various industry standards.

- Support fraud prevention strategies: Address verification acts as a frontline defense against unauthorized access and fraudulent activities, reinforcing the integrity of customer onboarding processes.

- Enhance employee safety and security: Accurate information about employees’ residences contributes to a safer workplace environment, allowing organizations to perform thorough background checks effectively.

Incorporating robust residence verification processes into your background checks enhances your organization’s risk analysis capabilities while fostering trust in client relationships. The implications extend beyond compliance, impacting operational efficiency.

Key Areas for Residence Verification in Background Checks and KYC

Effective residence verification is essential for adhering to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Organizations must ensure that they verify customer addresses accurately to mitigate risks associated with financial crimes. This crucial step helps institutions maintain compliance and avoid hefty penalties.

2. Importance of Accurate Address Information

Accurate address information enhances communication during background checks and KYC processes. When companies have verified addresses, they can streamline communication with customers, reducing the likelihood of errors or miscommunication. This clarity helps facilitate smoother onboarding experiences while ensuring that regulatory requirements are met.

3. Improving Business Operations

Reliable data supports business efficiency, especially in remote work arrangements. Companies benefit from accurate residence verification as it enables them to monitor employee locations effectively, assess risks, and improve operational strategies. By maintaining up-to-date address records, businesses can optimize resource allocation and enhance overall performance.

These areas highlight how critical residence verification is not just for compliance but also for fostering effective communication and improving business operations in today’s dynamic environment.

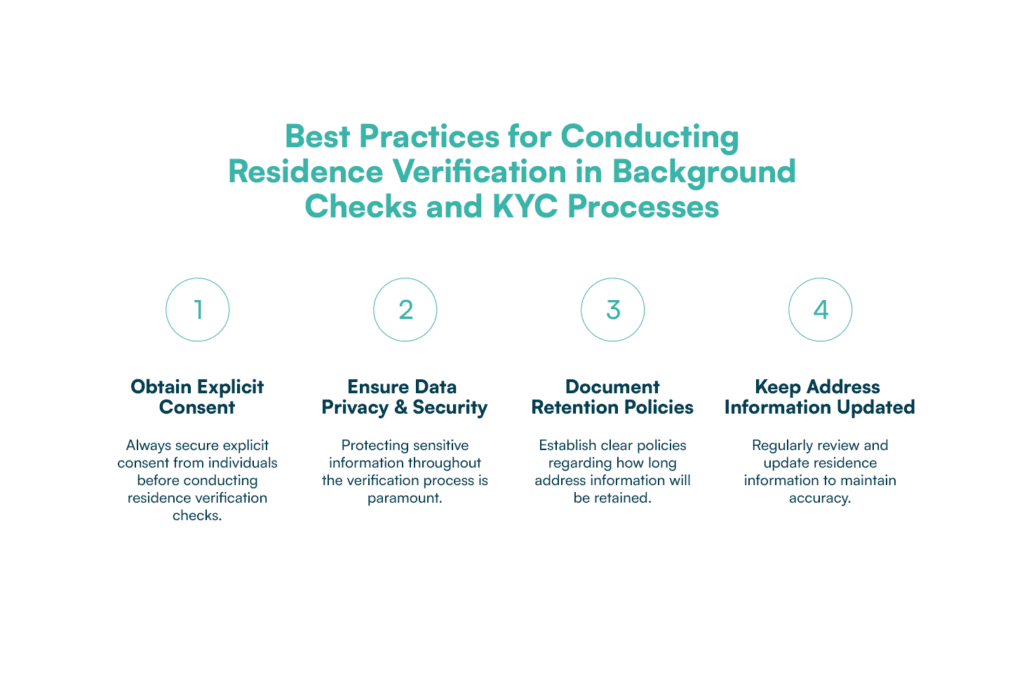

Best Practices for Conducting Residence Verification in Background Checks and KYC Processes

Implementing effective residence verification requires attention to several best practices:

- Obtain Explicit Consent: Always secure explicit consent from individuals before conducting residence verification checks. This practice not only complies with legal standards but also fosters trust between organizations and their clients.

- Ensure Data Privacy and Security: Protecting sensitive information throughout the verification process is paramount. Utilize encryption methods and secure storage solutions to safeguard personal data against unauthorized access.

- Document Retention Policies: Establish clear policies regarding how long address information will be retained. Transparency about document retention helps in building trust while ensuring compliance with relevant regulations.

- Keep Address Information Updated: Regularly review and update residence information to maintain accuracy. This is particularly important in dynamic environments like remote work, where employees may change their addresses frequently.

By integrating these practices into your residence verification processes, you enhance the integrity of background checks and KYC efforts. Organizations not only mitigate risks associated with inaccurate information but also demonstrate a commitment to responsible data management.

Technological Advancements in Residence Verification for Background Checks and KYC Compliance

Technological advancements have significantly transformed residence verification processes, particularly through the application of machine learning and AI algorithms. These innovations enhance both accuracy and efficiency in validating addresses, which is critical for effective background checks and KYC compliance.

How Machine Learning Algorithms Improve Address Validation

Machine learning algorithms analyze vast datasets to identify patterns and discrepancies in address information. By continuously learning from new data inputs, machine learning improves the precision of address validation. This reduces the likelihood of errors associated with manual verification methods.

Privacy Concerns Addressed: Balancing Individual Rights with Effective Residence Verification Practices

- Consent Withdrawal

Individuals hold the right to withdraw consent at any time during the verification process. This control empowers them to manage their personal data actively.

2. Transparent Communication

Organizations must prioritize clear communication regarding:

- Data Usage: Explain how personal information will be utilized in verification processes.

- Retention Periods: Provide clarity on how long the data will be stored.

- Third-Party Sharing: Inform individuals if their data will be shared with external entities, ensuring they understand potential implications.

Prembly and Residence Verification

Understanding the critical role that residence verification plays, Prembly has created a comprehensive verification process that includes address verification checks to ensure data accuracy and compliance.

Leveraging our experience and technology, Prembly offers you convenience with ease of verification. We help you in:

- Reducing risks associated with identity fraud.

- Build trust between businesses and customers, enhancing overall security.

- Uphold integrity by ensuring thorough due diligence.

- Strengthens the foundation for secure financial transactions and reduces potential threats.

By balancing individual rights with effective verification practices, companies can enhance compliance while respecting user autonomy.

Parting shots

Effective residence verification is essential in background checks and KYC processes, playing a crucial role in organizations’ risk management strategies. This practice not only helps with compliance regulations but also significantly contributes to reputation protection.

Prepared By Cynthia- Customer Success and Retention Executive at Prembly Kenya