People are significantly transforming the financial landscape as they increasingly seek alternatives to traditional financial systems, which they often view as unstable or exclusionary. Various compelling factors, including technological advancements and evolving societal needs, fuel the move from physical cash towards digital currencies. Digital currencies stand out for their convenience and efficiency, allowing people to make instant global transactions without the physical limitations or delays typical of traditional banking. The expanding online ecosystem further propels this shift, where developers smoothly integrate digital payments, providing users with a seamless transaction experience. With changes happening, there is a need to secures your online trading with KYC solutions, thats where Identitypass solutions come in.

People increasingly recognize cryptocurrencies and other digital assets as safeguards against inflation and currency devaluation, particularly in areas facing economic instability. They see this shift as a way to diversify investments and an opportunity for substantial returns as the digital economy grows. Moreover, digital currencies extend financial services to those without access to traditional banking, enabling economic participation for the previously excluded sectors of society.

About Deriv

Deriv, a leading online trading platform, exemplifies this shift. With 21 years of experience and executing over 60 million trades per month, Deriv offers access to a wide array of financial markets, including forex, commodities, synthetic indices, stock indices, and cryptocurrencies, available for trading around the clock. Deriv’s platforms, such as DTrader, Smart Trader, DMT5, and Deriv X, and the Deriv GO mobile app for multipliers trading, highlight the company’s innovative approach to online trading.

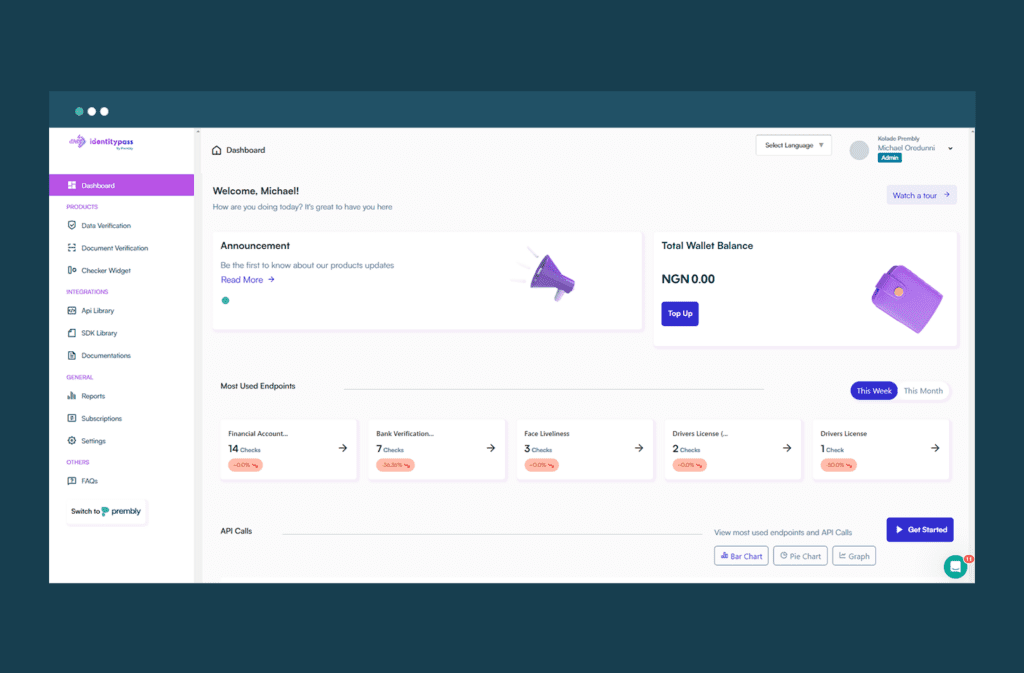

How Identitypass Enables Deriv to Prevent Fake Identities

However, Deriv encountered challenges with fraudulent users attempting to infiltrate their system, posing significant risks of identity theft and financial fraud. The company initially tried to manage these issues manually but soon realized the need for a robust solution to ensure that only legitimate users could access their platform. This led them to Identitypass, whose pricing and comprehensive services, including document, data, and biometrics verification, perfectly aligned with Deriv’s requirements. With Identitypass, Deriv quickly improved its ability to detect fake identities at the point of onboarding, effectively navigating the fraud challenges inherent in the decentralized digital currency space.

With Identitypass, Deriv now stands at the forefront of secure online trading, offering its diverse services to genuine users while ensuring exceptional prevention of identity theft and compliance in their markets.

How To Get Secures Online Trading KYC solutions

In a developing financial environment where online interactions have become the lifeblood of businesses, the demand for reliable identity verification has never been greater. Fortunately, Identitypass stands at the forefront of this revolution, providing businesses with the tools to thrive in a secure and trustworthy digital environment. By effectively addressing the challenge of fraudulent activities and counterfeit identity registrations, we protect businesses and cultivate trust among genuine users.

If your business grapples with identity verification challenges and faces the growing threat of fraud, it’s time to consider the robust solutions Identitypass offers. You can follow in the footsteps of Deriv, securing your business, building trust with your users, and embracing the future of secure online interactions. Sign up or book a demo session today for secure online trading with Identitypass’ KYC solutions.