The continued evolution of KYC (Know Your Customer) technologies is driven by rapid advancements in digital innovation. These developments aim to enhance KYC processes’ efficiency, effectiveness, and security while adapting to emerging markets’ unique characteristics and challenges.

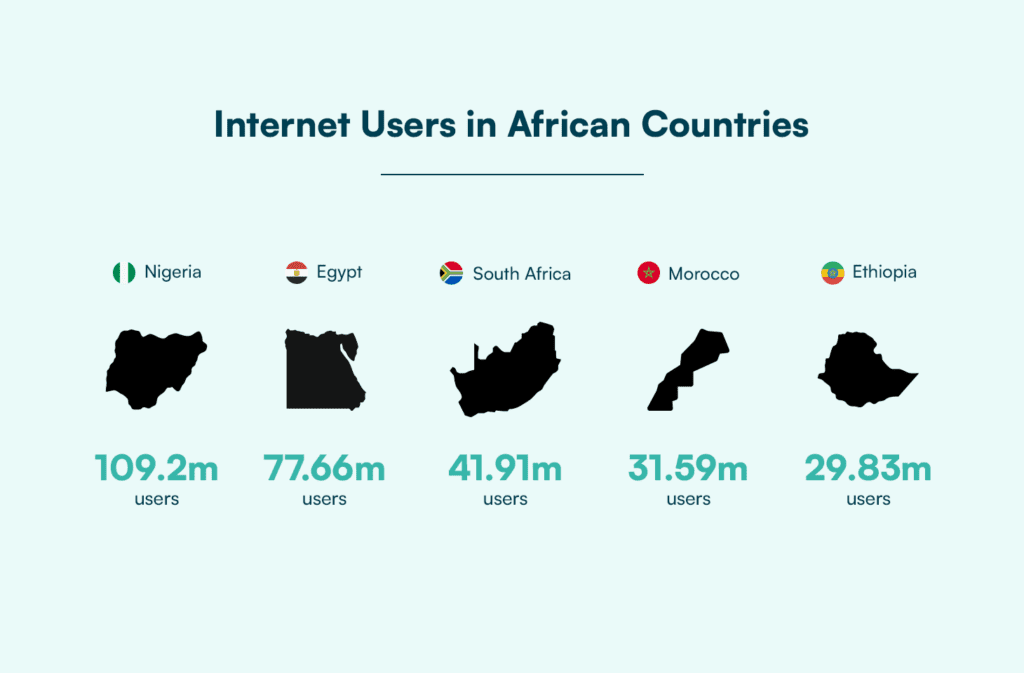

Over the last decade, emerging markets have witnessed a transformation in the digital KYC space. One significant trend shaping the future of KYC technologies is the increased adoption of mobile and digital platforms. Mobile technology has become pervasive allowing smartphones and other devices to be used for identity verification and KYC processes. In Africa today, internet penetration and net users in selected African countries have increased widely. In Nigeria alone, there are about 109.2 million internet users; Egypt has 77.66 million users; South Africa has 41.91 million users; Morocco has 31.59 million users; and Ethiopia has 29.83 million internet users. This has led to the implementation of mobile-based KYC solutions. This allows individuals to authenticate their identities remotely and provide the necessary documentation, eliminating the need for in-person visits to physical branches.

Internet in Africa

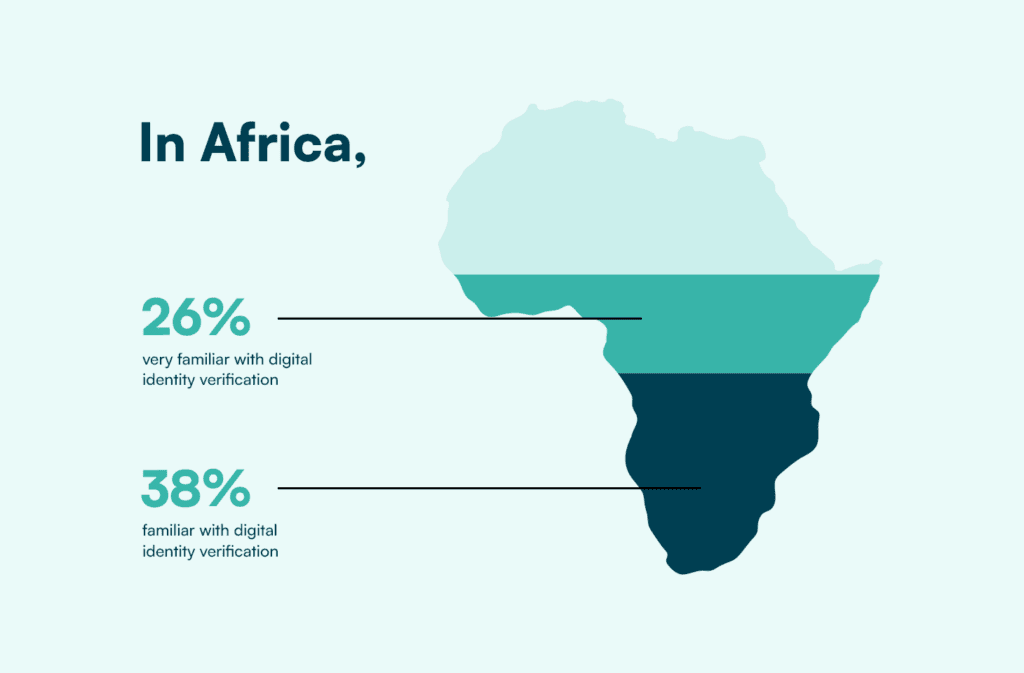

Unlike in the past, when most of the African populace did not know what KYC entails, today, the story is different. 38% are familiar with digital identity verification, and 26% are very familiar with digital identity verification. With mobile technologies, businesses are now enabled with greater accessibility, convenience, and cost-effectiveness in the KYC process.

What Does The Future Hold for Emerging Markets?

A significant emerging market-specific trend prone to influence KYC’s future is using alternative data sources for KYC purposes. Traditional KYC processes heavily rely on official identification documents, which can be challenging for individuals in emerging markets who need formal identification. To address this, innovative solutions are leveraging alternative data, such as social media profiles, utility bill payments, or transaction histories, to establish the identity and creditworthiness of individuals. This enables digital businesses, especially financial institutions, and loaning platforms, to extend services to those without traditional identification documents and promotes financial inclusion.

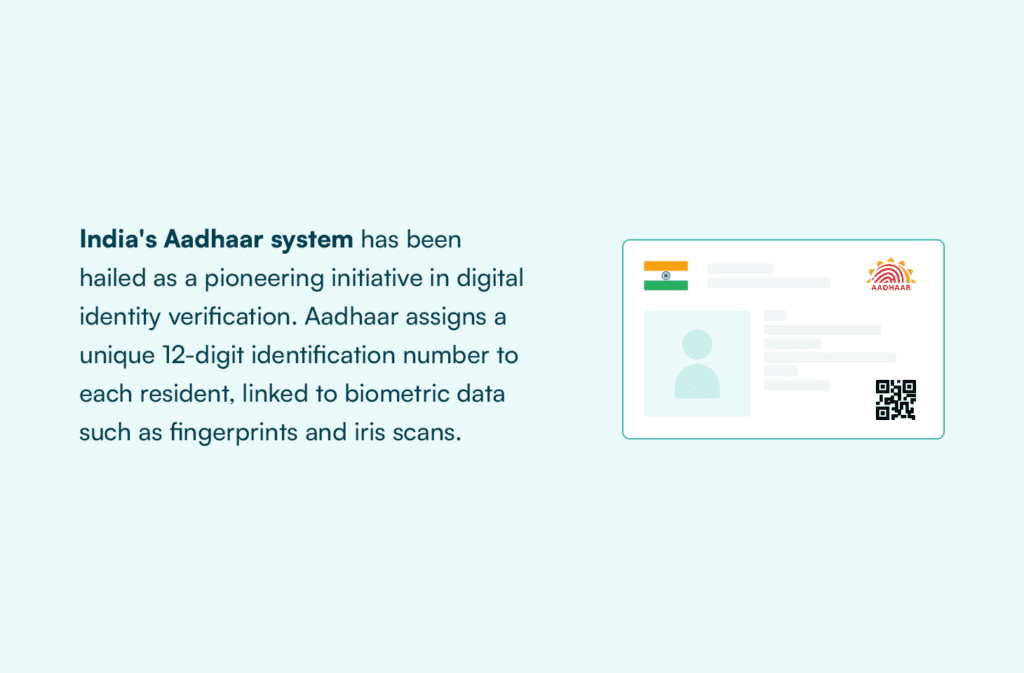

Successful implementations of advanced KYC in select emerging markets have demonstrated the transformative impact of leveraging technology to enhance customer identification processes. For example, India’s Aadhaar system has been hailed as a pioneering initiative in digital identity verification. Aadhaar assigns a unique 12-digit identification number to each resident, linked to biometric data such as fingerprints and iris scans. This system has enabled financial institutions and businesses to streamline their KYC processes, reduce fraud, and extend financial services to previously underserved populations.

Furthermore, regulatory changes and initiatives are significant in driving the evolution of KYC technologies in emerging markets. Potential regulatory changes will definitely shape the future of KYC in emerging markets. Regulators are increasingly recognizing the importance of striking the right balance between customer protection and fostering financial inclusion. Regulatory frameworks that embrace risk-based approaches and innovative digital solutions must be considered to enable emerging markets to implement effective KYC measures while minimizing barriers to financial access.

One key lesson is the importance of robust infrastructure and interoperability. Effective KYC systems require reliable and scalable technology infrastructure, including secure data storage, connectivity, and integration capabilities. Additionally, ensuring interoperability between different systems and databases is crucial to enable seamless exchange of customer information and facilitate a unified KYC process.

Importance Of Collaboration Between Stakeholders

To sustain KYC processes for the future of emerging markets, the importance of collaboration between financial institutions, regulators, and identity verification solutions providers cannot be overstated. Collaboration among these stakeholders is crucial for building effective and efficient KYC frameworks that meet regulatory requirements, leverage technological advancements, and address the unique challenges of emerging markets.

One key aspect of collaboration is establishing clear lines of communication and cooperation between financial institutions and regulators. Regulators play a vital role in setting standards and guidelines for KYC processes to ensure compliance with legal and regulatory frameworks. By engaging in regular dialogues and consultations, financial institutions can provide valuable insights and feedback to regulators, helping shape KYC regulations that are practical and balanced and ultimately promote financial inclusion. Likewise, regulators can provide guidance and updates on regulatory expectations, enabling financial institutions to stay compliant and implement KYC processes effectively.

More on KYC in New Businesses

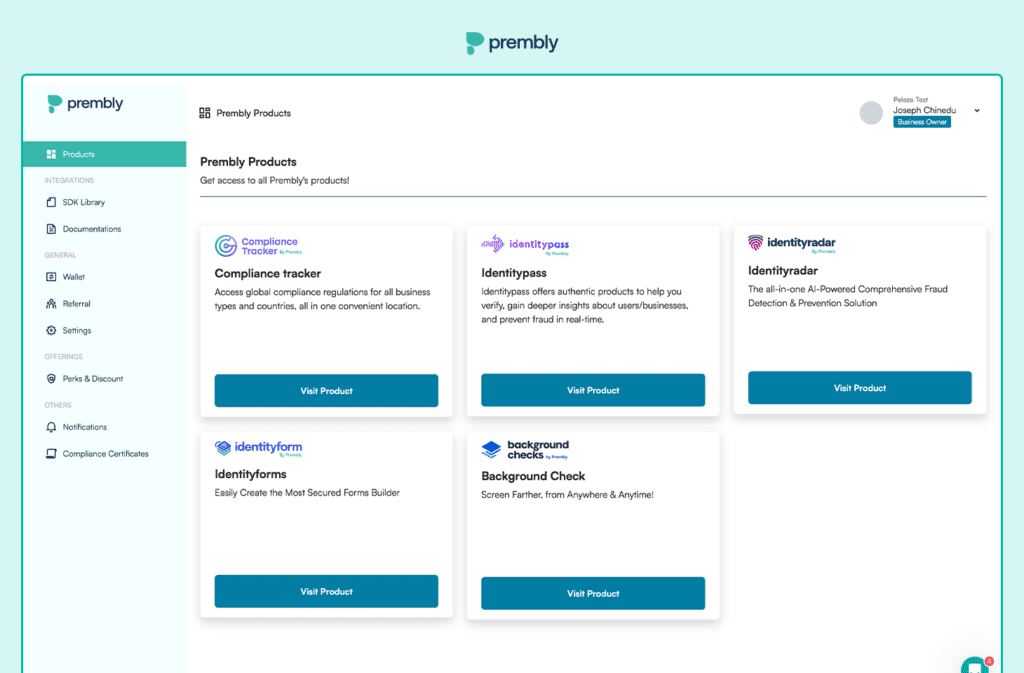

Collaboration with digital identity solutions providers is equally important. Providers like Identitypass by Prembly offer innovative solutions and platforms that can enhance the efficiency and effectiveness of KYC processes. By working closely with these providers, financial institutions can benefit from their expertise and access cutting-edge technologies such as artificial intelligence, machine learning, biometrics, and blockchain. Collaborative partnerships can help financial institutions adopt and customize technology solutions to meet their specific KYC needs while ensuring data security and compliance.

Another critical collaboration aspect is building a unified approach for KYC in emerging markets. Emerging markets often face unique challenges, including limited resources, fragmented regulatory landscapes, and diverse customer segments. A unified approach involves aligning regulatory requirements, industry standards, and best practices to create a cohesive and harmonized KYC framework. This entails collaboration among regulators, financial institutions, and technology providers to develop common standards, interoperable systems, and shared data repositories, where appropriate. A unified approach helps streamline KYC processes, reduce duplication of efforts, and facilitate information sharing while maintaining robust security and privacy measures.

Collaboration also enables knowledge sharing and capacity building. Financial institutions, regulators, and technology providers can exchange experiences, insights, and lessons learned, contributing to the continuous improvement of KYC practices. Capacity-building programs, training sessions, and workshops can further enhance the understanding and implementation of KYC processes, particularly for smaller financial institutions or organizations in emerging markets with limited resources.

Looking Forward

In summary, KYC is vital to global business operations, ensuring compliance with regulations and mitigating the risk of financial crimes. Implementing effective KYC processes in emerging markets is essential for promoting financial inclusion and economic growth. The future of KYC in these markets lies in leveraging digital technology, embracing regulatory changes, and exploring emerging technologies.

Businesses, regulators, and consumers must prepare for these changes by investing in digital infrastructure, fostering collaboration between stakeholders, and promoting consumer awareness about the benefits of KYC. By doing so, emerging markets can harness the power of KYC to unlock the transformative potential of formal financial services for all individuals, contributing to sustainable economic development.

About Prembly

At Prembly, we build go-to, user-friendly AI-powered Security, Infrastructure, and Compliance software for Identity Verification, Fraud Prevention/Detection market solutions that help digital businesses in emerging markets safely acquire, onboard customers, and perform seamless transactions across borders without restrictions.

We are trusted by hundreds of digital businesses in Identity Verification, Fraud Detection/Prevention, and Background Checks; to safely acquire and onboard customers and perform seamless transactions maintaining required regulatory compliance checks.

Prembly’s vision involves promoting trust and creating a safe digital space where businesses deal only with the right people and can easily acquire honest individuals as customers and partners. We aim to make the internet safer and more secure for digital businesses across emerging markets to transact globally with trust and without restrictions.

With monthly identity verification rates in millions, 100s of digital businesses across emerging markets are being Powered to Greatness by Prembly’s vast array of AI-powered software, including leading financial institutions, Crypto, logistics & mobility, FMCGs, Gaming, Insurance, Alcohol & Tobacco, and Public sectors.

Learn more about our security and compliance solutions here.

Leave a Reply

You must be logged in to post a comment.